Imprescindibles

Ficción

No Ficción

Ciencias y tecnología Biología Ciencias Ciencias naturales Divulgación científica Informática Ingeniería Matemáticas Medicina Salud y dietas Filología Biblioteconomía Estudios filológicos Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura

Humanidades Autoayuda y espiritualidad Ciencias humanas Derecho Economía y Empresa Psicología y Pedagogía Filosofía Sociología Historia Arqueología Biografías Historia de España Historia Universal Historia por países

Infantil

Juvenil

#Jóvenes lectores Narrativa juvenil Clásicos adaptados Libros Wattpad Libros Booktok Libros de influencers Libros de Youtubers Libros Spicy Juveniles Libros LGTBIQ+ Temas sociales Libros ciencia ficción Libros de acción y aventura Cómic y manga juvenil Cómic juvenil Manga Shonen Manga Shojo Autores destacados Jennifer L. Armentrout Eloy Moreno Nerea Llanes Hannah Nicole Maehrer

Libros de fantasía Cozy Fantasy Dark academia Hadas y Fae Romantasy Royal Fantasy Urban Fantasy Vampiros y hombres lobo Otros Misterio y terror Cozy mistery Policiaca Spooky Terror Thriller y suspense Otros

Libros románticos y de amor Dark Romance Clean Romance Cowboy Romance Mafia y amor Romance dramatico Romcom libros Sport Romance Otros Clichés Enemies to Lovers Friends to Lovers Hermanastros Slow Burn Fake Dating Triángulo amoroso

Cómic y manga

Novela gráfica Novela gráfica americana Novela gráfica europea Novela gráfica de otros países Personajes, series y sagas Series y sagas Star Wars Superhéroes Cómics DC Cómics Marvel Cómics otros superhéroes Cómics Valiant

eBooks

Literatura Contemporánea Narrativa fantástica Novela de ciencia ficción Novela de terror Novela histórica Novela negra Novela romántica y erótica Juvenil Más de 13 años Más de 15 años Infantil eBooks infantiles

Humanidades Autoayuda y espiritualidad Ciencias humanas Economía y Empresa Psicología y Pedagogía Filosofía Historia Historia de España Historia Universal Arte Cine Música Historia del arte

Ciencia y tecnología Ciencias naturales Divulgación científica Medicina Salud y dietas Filología Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura Estilo de vida Cocina Guías de viaje Ocio y deportes

Kathryn Lasky

KATHRYN LASKY

Recibe novedades de KATHRYN LASKY directamente en tu email

Filtros

Del 1 al 17 de 17

PRESSES POCKET 9782266293921

Tapa blanda

PRESSES POCKET 9782266293891

Tapa blanda

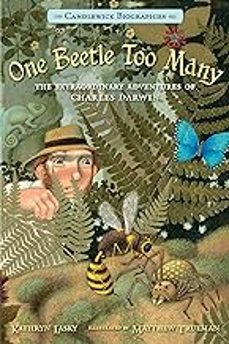

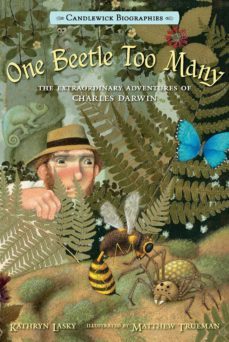

SEIGHENSA 9780763668433

Laskys text balances the exuberant artwork with well-organized information, gracefully sprinkling in quotes from Darwin." School Library Journal (starred review) In a clear, engaging narrative, Kathryn Lasky takes readers along on Darwins journey, from his beetle-collecting childhood to his observations of variations in plants and animals, suggesting that all living things are evolving over time. Matthew Truemans striking mixed-media illustrations include actual objects found in nature, enhancing this compelling look at the man behind the bold theory that would change the way we think about the worldand ourselves.Back matter includes a bibliography.

Ver más

Bolsillo

EDICIONES B, S.A. 9788466628877

Soren nace en el bosque de Tyto, un reino tranquilo en el que habitan las lechuzas comunes. Pero el mal está al acecho en el mundo de las lechuzas, un mal que amenaza con hacer pedazos la paz de Tyto y cambiar el curso de la vida de Soren para siempre. Soren es capturado y trasladado a un desfiladero sombrío e inhóspito. Lo llaman un orfanato, pero la joven lechuza cree que es algo mucho peor. Él y su amigo Gylfie saben que la única escapatoria está arriba. Para huir, tendrán que hacer algo que no han hecho nunca: volar. Así comienza un viaje mágico. Por el camino, Soren y Gylfie conocen a Twilight y Digger. Los cuatro se unen para buscar la verdad y proteger el mundo de las lechuzas de un peligro inconcebible.

Ver más

Tapa blanda

EDICIONES B, S.A. 9788466628891

Desde que Soren fue secuestrado e internado en el orfanato, ha estado esperando el día en que volvería a ver a su hermana Eglantine. Ahora ésta ha regresado a la vida de Soren, pero ha sufrido experiencias terriblemente traumáticas. Para colmo de males, el mentor de Soren ha desaparecido. Una intuición muy profunda hace sospechar a Soren que, de alguna manera, ambos acontecimientos están relacionados.

Ver más

Tapa blanda

EDICIONES B, S.A. 9788466628884

Segunda entrega de las aventuras de Soren y sus compañeros, en su heroica aventura por convertirse en guardianes de Ga’Hoole. Empezó como un sueño: llegar al mítico árbol de Ga’Hoole, un lugar de ley

Ver más

Tapa blanda

EDICIONES B, S.A. 9788466628907

La tensión se desencadena en el reino de los búhos cuando las tropas del Mal inician una ofensiva contra los defensores del Bien. Enfurecido por su enfrentamiento con Soren y arrastrado por la sed de poder que le consume, Kludd y su grupo, los Puros, se lanzan al ataque sobre el Árbol de Ga'Hoole. Los nobles búhos que allí habitan deben combatir con ferocidad para proteger su hogar y defender su honor.

Ver más

Tapa blanda

HARPERCOLLINS PUB. 9780007418923

"The fantastical elements are well integrated with the natural history and the result is a convincing and suspenseful fantasy! A compulsive read." School Librarian "With all the right elements -- a hero that's destined for greatness and the struggle between light and darkness -- Lasky's Guardians debut is a high-flying hoot. Soren's tale is suspenseful and riveting, and by the book's end, readers will even be impressed with how much they've learned about owls. Reminiscent of Brian Jacques's Redwall and Robin Jarvis's Deptford Mice, The Capture is bound to catch fantasy fans in its talons." Barnes and Noble Reviews "The story's fast pace, menacing bad guys, and flashes of humor make this a good choice for reluctant readers, while the underlying message about the power of legends provides a unifying element and gives strong appeal for fantasy fans." School Library Journal

Ver más

Otros

Kathryn Lasky y HAFNER, MARYLIN

CORGI TRANSWORLD 9780440417507

Tapa blanda

SALAMANDRA (PUBLICACIONES Y EDICIONES SALAMANDRA, S.A.) 9788478887767

Con este diario ficticio de María Antonieta continúa la serie Diarios de Reinas y Princesas, en la que descubrirás la vida de los personajes feminos más interesantes de la Historia. Concluido el diario, encontraras un epilogo con el resumen de la vida de cada protagonista, ademas de un complemento de ilustraciones, mapas, arboles genealogicos e informacion diversa que te ilustrara sobre el contexto historcio en el que se desarrollaron los hechos relatados en el diario.

Ver más

Tapa dura

MONTENA 9788475159096

July y Liberty Starbuck, dos hermanos gemelos con poderes telepáticos, acompañan a su padre a Florida, a quien le han encargado que investigue unos misteriosos residuos tóxicos que están devastando la flora y fauna marinas. Pronto los gemelos recibiran mensajes de un banco de delfines, decididos a recuperar a Espiritu de Luna, el delfin blanco que se ha perdido por culpa del veneno esparcido en el mar. Encuadernacion: rustica.

Ver más

Tapa blanda

JUVENTUD 9788426135681

En un vaixell pirata tothom desconfia de tothom i tenir amics pot arribar a ser complicat. El somni del pirata Bob és tenir un tresor enterrat, però el preocupa que després els seus amics el puguin e

Ver más

Tapa dura

EDICIONES B, S.A. 9788466639538

Eglantine se ve sometida al influjo de un extraño sueño. Cuando Soren se percata de su estado, Eglantine desaparece y los sueños se convierten en una terrible pesadilla que pone el Gran Árbol Ga''Hoole en peligro. Soren debe liderar la brigada de brigadas para rescatar a su hermana.

Ver más

Tapa dura

EDICIONES B, S.A. 9788466644068

Sexta entrega de "Los guardianes de Ga'Hoole", la serie de novelas que ha inspirado la gran pel#cula en 3D, con m#s de un mill#n de ejemplares vendidos en Estados Unidos. Soren y su grupo se dirigen a los misteriosos Reinos del Norte para reunir aliados y aprender el arte de la guerra; su intenci#n es prepararse para la batalla que se avecina contra las siniestras fuerzas de los Puros. Mientras, en los Reinos del Sur, St. Aggies ha sucumbido a los Puros, que est#n utilizando sus recursos para planear una invasi#n final y definitiva del Gran #rbol de Ga#Hoole. Con todo el futuro de la comunidad en juego, el parlamento de Ga#Hoole deber# decidir si unirse o no las fuerzas de los brutales Skench y Sporn y a los dispersos supervivientes de St. Aggies que todav#a son leales a su causa. Una gran batalla se perfila en el horizonte...

Ver más

Tapa dura

Del 1 al 17 de 17