Imprescindibles

Ficción

No Ficción

Ciencias y tecnología Biología Ciencias Ciencias naturales Divulgación científica Informática Ingeniería Matemáticas Medicina Salud y dietas Filología Biblioteconomía Estudios filológicos Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura

Humanidades Autoayuda y espiritualidad Ciencias humanas Derecho Economía y Empresa Psicología y Pedagogía Filosofía Sociología Historia Arqueología Biografías Historia de España Historia Universal Historia por países

Infantil

Juvenil

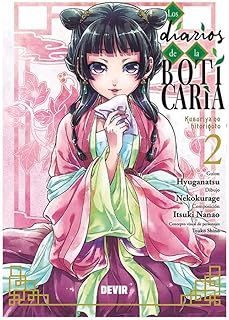

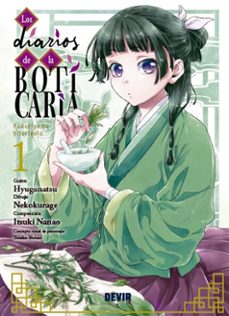

#Jóvenes lectores Narrativa juvenil Clásicos adaptados Libros Wattpad Libros Booktok Libros de influencers Libros de Youtubers Libros Spicy Juveniles Libros LGTBIQ+ Temas sociales Libros ciencia ficción Libros de acción y aventura Cómic y manga juvenil Cómic juvenil Manga Shonen Manga Shojo Autores destacados Jennifer L. Armentrout Eloy Moreno Nerea Llanes Hannah Nicole Maehrer

Libros de fantasía Cozy Fantasy Dark academia Hadas y Fae Romantasy Royal Fantasy Urban Fantasy Vampiros y hombres lobo Otros Misterio y terror Cozy mistery Policiaca Spooky Terror Thriller y suspense Otros

Libros románticos y de amor Dark Romance Clean Romance Cowboy Romance Mafia y amor Romance dramatico Romcom libros Sport Romance Otros Clichés Enemies to Lovers Friends to Lovers Hermanastros Slow Burn Fake Dating Triángulo amoroso

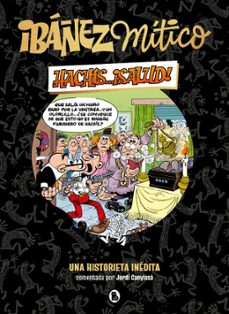

Cómic y manga

Novela gráfica Novela gráfica americana Novela gráfica europea Novela gráfica de otros países Personajes, series y sagas Series y sagas Star Wars Superhéroes Cómics DC Cómics Marvel Cómics otros superhéroes Cómics Valiant

eBooks

Literatura Contemporánea Narrativa fantástica Novela de ciencia ficción Novela de terror Novela histórica Novela negra Novela romántica y erótica Juvenil Más de 13 años Más de 15 años Infantil eBooks infantiles

Humanidades Autoayuda y espiritualidad Ciencias humanas Economía y Empresa Psicología y Pedagogía Filosofía Historia Historia de España Historia Universal Arte Cine Música Historia del arte

Ciencia y tecnología Ciencias naturales Divulgación científica Medicina Salud y dietas Filología Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura Estilo de vida Cocina Guías de viaje Ocio y deportes

JOHN A. TRACY

Recibe novedades de JOHN A. TRACY directamente en tu email

Filtros

Del 1 al 5 de 5

LIMUSA 9789681813871

Esta obra presenta, de la A a la Z la interpretación de informes financieros para inversionistas, empresarios, administradores, ejecutivos y responsables de la toma de decisiones. Esta nueva edición está totalmente actualizada, se ampliaron temas como el método de depreciación, el goodwill y los activos de operación a largo plazo. Considera los escándalos financieros recientes y el impacto de la ley Sarbanes-Oxley en el ámbito financiero internacional. Incluye un capítulo nuevo sobre contadores independientes, audotorías y fallas de auditoría.

Ver más

Tapa blanda

IDG BOOKS 9780764553141

Whether you're a small business owner or just want to understand your 401(k) statements, a basic understanding of accounting practices is important for anyone who handles money. Knowing how to balance the books and stay in the black is vital for keeping a business afloat or keeping your checkbook balanced. If you need to keep the books in order, this new edition of Accounting For Dummieshelps you get a handle on all those columns of numbers. It offers fully up-to-date coverage of accounting basics and includes all the tools and tips you need to: Make sense of bookkeeping basics Read a financial statement Manage budgets for a better bottom line Analyze business strengths and weaknesses Evaluate accounting methods and business structures John Tracy, Certified Public Accountant and former professor of accounting, presents everything you need to know to master modern accounting. Packed with practical guidance and real-world scenarios, this handy guide covers it all: Making and reporting profit Reporting a company's financial condition Preparing financial reports Budgeting profit and cash flow Choosing and implementing accounting methods How to read a financial report Audits, accounting fraud, and audit failure How to decipher accounting jargon And savvy ways businesses use accounting From balance sheets, to income statements, to inventory, almost every aspect of modern business requires basic accounting techniques. You'll learn it all here. Plus, this new edition covers the impact of the Sarbanes-Oxley Act of 2002, recent accounting fraud scandals, the establishment of the Public Company Accounting Oversight Board, and the new financial reporting standards for stock options and financial derivatives.

Ver más

Tapa blanda

LEA 9780470125083

If youre a small business owner, managing the financial affairs of your business can seem like a daunting taskand its one that far too many people muddle through rather than seek help. Now, theres a tool-packed guide designed to help you manage your finances and run your business successfully!Small Business Financial Management Kit For Dummies explains step by step how to handle all your financial affairs, from preparing financial statements and managing cash flow to streamlining the accounting process, requesting bank loans, increasing profits, and much more. The bonus CD-ROM features handy reproducible forms, checklists, and templatesfrom a monthly expense summary to a cash flow statementand provides how-to guidance that removes the guesswork in using each tool. Youll discover how to:- Plan a budget and forecast- Streamline the accounting process- Improve your profit and cash flow- Make better decisions with a profit model- Raise capital and request loans- Invest company money wisely- Keep your business solvent- Choose your legal entity for income tax- Avoid common management pitfalls- Put a market value on your businessComplete with ten rules for small business survival and a financial glossary, Small Business Financial Management Kit For Dummies is the fun and easy way to get your finances in order, perk up your profits, and thrive long term!

Ver más

Tapa blanda

Del 1 al 5 de 5