Imprescindibles

Ficción

No Ficción

Ciencias y tecnología Biología Ciencias Ciencias naturales Divulgación científica Informática Ingeniería Matemáticas Medicina Salud y dietas Filología Biblioteconomía Estudios filológicos Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura

Humanidades Autoayuda y espiritualidad Ciencias humanas Derecho Economía y Empresa Psicología y Pedagogía Filosofía Sociología Historia Arqueología Biografías Historia de España Historia Universal Historia por países

Infantil

Juvenil

#Jóvenes lectores Narrativa juvenil Clásicos adaptados Libros Wattpad Libros Booktok Libros de influencers Libros de Youtubers Libros Spicy Juveniles Libros LGTBIQ+ Temas sociales Libros ciencia ficción Libros de acción y aventura Cómic y manga juvenil Cómic juvenil Manga Shonen Manga Shojo Autores destacados Jennifer L. Armentrout Eloy Moreno Nerea Llanes Hannah Nicole Maehrer

Libros de fantasía Cozy Fantasy Dark academia Hadas y Fae Romantasy Royal Fantasy Urban Fantasy Vampiros y hombres lobo Otros Misterio y terror Cozy mistery Policiaca Spooky Terror Thriller y suspense Otros

Libros románticos y de amor Dark Romance Clean Romance Cowboy Romance Mafia y amor Romance dramatico Romcom libros Sport Romance Otros Clichés Enemies to Lovers Friends to Lovers Hermanastros Slow Burn Fake Dating Triángulo amoroso

Cómic y manga

Novela gráfica Novela gráfica americana Novela gráfica europea Novela gráfica de otros países Personajes, series y sagas Series y sagas Star Wars Superhéroes Cómics DC Cómics Marvel Cómics otros superhéroes Cómics Valiant

Cómics Libros de ilustración Cómic de humor Comic erótico Historia y técnica del cómic Cómic infantil y juvenil Cómic infantil Cómic juvenil

Top más leídos

eBooks

Literatura Contemporánea Narrativa fantástica Novela de ciencia ficción Novela de terror Novela histórica Novela negra Novela romántica y erótica Juvenil Más de 13 años Más de 15 años Infantil eBooks infantiles

Humanidades Autoayuda y espiritualidad Ciencias humanas Economía y Empresa Psicología y Pedagogía Filosofía Historia Historia de España Historia Universal Arte Cine Música Historia del arte

Ciencia y tecnología Ciencias naturales Divulgación científica Medicina Salud y dietas Filología Estudios lingüísticos Estudios literarios Historia y crítica de la Literatura Estilo de vida Cocina Guías de viaje Ocio y deportes

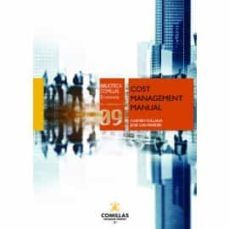

Carmen Fullana Belda

Carmen Fullana Belda es doctora en Ciencias Económicas y Empresariales por la Universidad Complutense de Madrid, profesora del Departamento de Gestión Financiera de la Universidad Pontificia Comillas de Madrid (ICADE) y coordinadora de su Programa de Doctorado en Competitividad Empresarial y Territorial, Innovación y Sostenibilidad. Ha sido profesora en la Facultad de Ciencias Económicas y Empresariales de la Universidad Complutense de Madrid. Su experiencia en el mundo empresarial se ha desarrollado en el área del análisis funcional de sistemas financieros en empresas de ámbito internacional. Sus líneas de investigación se centran sobre distintos aspectos de la economía de la empresa, como son la contabilidad y la valoración y gestión sostenible de recursos mediante modelos de simulación. Ha publicado libros sobre materias de economía de la empresa, así como artículos en revistas de investigación nacionales e internacionales de prestigio.

Recibe novedades de CARMEN FULLANA BELDA directamente en tu email

Filtros

Del 1 al 3 de 3

Universidad Pontificia Comillas 9788484686033

This book presents a compendium of the current managerial accounting system, in its theoretical and methodological aspects. Internal accounting is used by companies to determine their costs and analytical results, which represent essential information for their management.As a professional reference book, oriented to educational purposes at University level, the authors hope that the text serves the purpose of being useful in terms of remembering concepts, reviewing procedures and solutions, and observing new approaches. Valid processes are addressed for all types of companies, not only industrial ones, but also commercial and service ones, with cases and solutions adapted to their characteristics.Detailed knowledge of cost formation inevitably reveals opportunities for improvement in working methods, in product design, in scheduling production operations and in the configuration of the organization itself. Nowadays, it is unquestionable that the analysis and interpretation of costs represents a powerful management tool to develop responsibility as professionals or company managers.

Ver más

eBook

Delta Publicaciones 9788496477919

El presente libro tiene como objetivo estudiar los aspectos teóricos y metodológicos que actualmente siguen las empresas para la determinación de sus costes y resultados internos, abarcando el campo actual de la contabilidad analítica de costes junto con los temas clásicos de contabilidad de gestión que forman parte de los programas universitarios en estas materias.

Ver más

Tapa blanda

Universidad Pontificia Comillas (Publicaciones) 9788484688587

This book presents a compendium of the current managerial accounting system, in its theoretical and methodological aspects. Internal accounting is used by companies to determine their costs and analytical results, which represent essential information for their management.The textbook is oriented to educational purposes, at University, as a textbook for business administration and management degrees and to Organizations as a reference book for professional practitioners.University teaching has undergone an evolution that has entailed changes in regard to the traditional way of approaching subjects, requiring the student to stay more intensely involved with the teaching-learning process. In this framework, the subject materials become a pillar of great importance in the study methodology, and the main objective of the subjects textbook is to display content that provides high pedagogical value.This textbook is intended to be a complete teaching material, in an attempt to combine the clarity of the exposition with the rigor and depth of the content. In order to achieve this objective, the book includes a large number of examples that clarify concepts, and practical exercises that facilitate and reinforce the understanding of calculation methods or processes.As a professional reference book, the authors hope that the text serves the purpose of being useful in terms of remembering concepts, reviewing procedures and solutions, and observing new approaches. Valid processes are addressed for all types of companies, not only industrial ones, but also commercial and service ones, with cases and solutions adapted to their characteristics.Detailed knowledge of cost formation inevitably reveals opportunities for improvement in working methods, in product design, in scheduling production operations and in the configuration of the organization itself. Nowadays, it is unquestionable that the analysis and interpretation of costs represents a powerful management tool to develop responsibility as professionals or company managers

Ver más

Tapa blanda

Del 1 al 3 de 3